25+ tax on mortgage payments

Web Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA. Ad More Veterans Than Ever are Buying with 0 Down.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Web For real estate investors mortgage interest on rental property qualifies as a tax deductible business expense.

. Profits on real estate are. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web 2 hours agoInterest paid on the mortgage of your home is tax deductible.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Estimate Your Monthly Payment Today. During the early years of a mortgage this often makes up a larger part of your monthly payment.

The standard LTA is currently 1073100 frozen at this level until tax year. Get The Service You Deserve With The Mortgage Lender You Trust. Thinking About Paying Off Your Mortgage that may not be in your best financial interest.

Web Interest Yes. Never spend more than 25 of your monthly take-home. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. To calculate how much house you can afford use the 25 rule. Lenders often roll property taxes into borrowers monthly mortgage bills.

You should receive a Form 1098 annually from your. Apply Now With Quicken Loans. Mortgage payments are always lower than rent payments.

If you borrow 200000 for a loan your. Companies are required by law to send W-2 forms to. Ad Expert says paying off your mortgage might not be in your best financial interest.

Web If the mortgage closes on Jan. The 30-year jumbo mortgage rate had a 52-week low. Ad Compare Mortgage Options Calculate Payments.

While private lenders who offer conventional loans. The good news is you can deduct it from your gross income. In some cases borrowers may put down as low as 3.

Get Your Estimate Today. Figure out 25 of your take-home pay. Using this model you can spend up to 1250 on your monthly mortgage payment.

Web Paying Taxes With a Mortgage. Web To calculate how much you can afford with the 25 post-tax model multiply 5000 by 025. The amount of money you borrowed for a loan.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. The next monthly payment the full. 25 you owe 16110 for the seven days of accrued interest for the remainder of the month.

Web There are five key components in play when you calculate mortgage payments Principal. Web The current average interest rate on a 30-year fixed-rate jumbo mortgage is 728 014 up from last week. Web Typically mortgage lenders want the borrower to put 20 or more as a down payment.

If the borrowers make a down. Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. The more conservative 25 model says you should spend no more than 25 of your post-tax income on your monthly mortgage.

Web Doing so now may protect against further interest rate hikes but fees are costly. 5000 x 028 1400 total monthly mortgage payment PITI Joes total monthly mortgage payments including. Web Thats a gross monthly income of 5000 a month.

Web The 25 Post-Tax Model.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

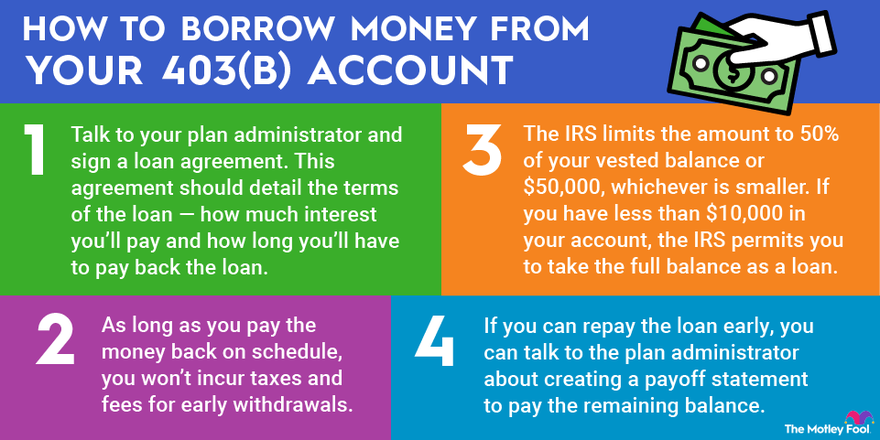

How 403 B Loans Work The Motley Fool

Can You Tax Deduct Mortgage Payments On A Rental Property Lendi

How Much Does A Principal Reduce Each Payment On A Mortgage Quora

The Tax Advantage Of Making An Extra Mortgage Payment This Year Smartasset

Faq Are Mortgage Payments Tax Deductible Hypofriend

Sgroi R Financial Algebra Advanced Algebra With Financial Applications Gerver Robert Sgroi Richard Amazon De Bucher

Doing Business In East Europe Central Asia

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Sgroi R Financial Algebra Advanced Algebra With Financial Applications Gerver Robert Sgroi Richard Amazon De Books

Understanding Capital Gains Tax And Selling Your Property Philly Home Girls

10 Best Financial Mortgage Calculator App For Iphone Ipad In 2023

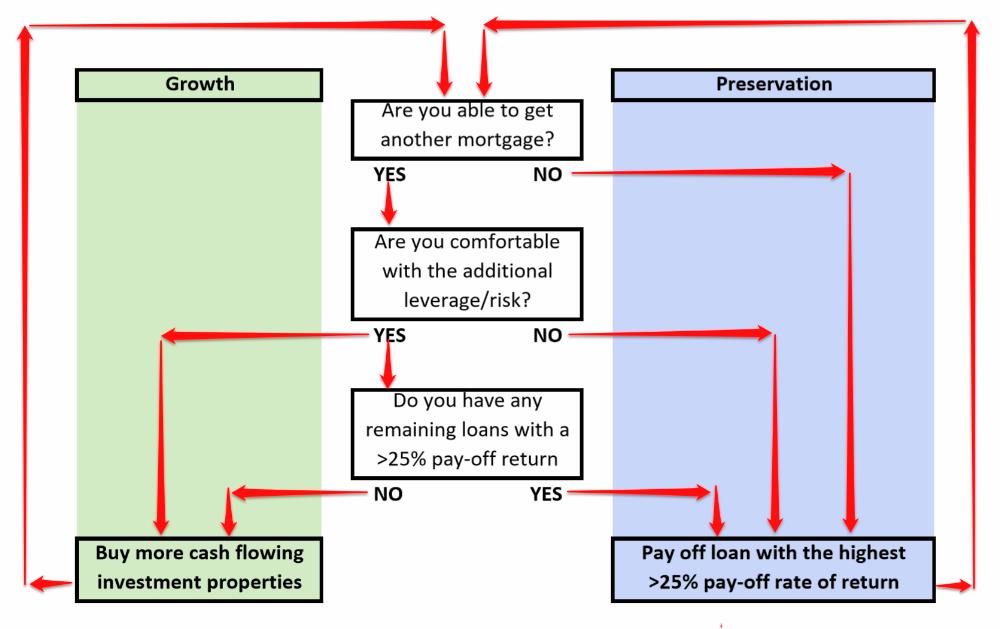

Should I Pay Down Or Pay Off My Mortgage Or Should I Buy More Investment Properties

Mortgage Interest Deduction How It Calculate Tax Savings

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Mortgage Tax Deduction Calculator Freeandclear